Introduction: India’s consumer market is witnessing a dramatic face-off between legacy FMCG giants and nimble direct-to-consumer (D2C) challengers. Once, shoppers bought soaps and snacks from kirana (mom-and-pop) stores dominated by big conglomerates like Hindustan Unilever, ITC or Nestlé. Today, young consumers are embracing digital brands. In fact, one industry report notes over 600 new D2C brands have launched in India since 2016 – a 25% jump in 2023 alone (economictimes.indiatimes.com). No wonder analysts predict India’s D2C market will more than triple to ~$61.3 billion by FY27 (economictimes.indiatimes.com). This race matters because India’s FMCG brands – whether selling biscuits, beverages or beauty products – must adapt or lose share. The stakes are high: the Indian FMCG market was valued at about $230 billion in 2023 (maximizemarketresearch.com). In this new era, personalized products, social-media buzz and instant delivery are keys. As one surprising stat shows, India now has roughly 700 million internet users and 190 million online shoppers (entrepreneur.com) – a digital consumer base that D2C brands expertly target. This blog dives into the FMCG vs D2C battle in India in 2025: how traditional big FMCG companies are retooling to compete, and what it means for the future of retail and Indian consumer behavior.

Overview of FMCG Brands in India

India’s FMCG sector (Fast-Moving Consumer Goods) spans food & beverages, personal care, home care and more. It is one of the country’s largest industries (about $230 billion and growing (maximizemarketresearch.com). Major companies in this space include Hindustan Unilever (HUL), ITC, Nestlé India, Dabur, Britannia, Marico, Emami, Godrej Consumer and Adani Wilmar, among others. These big FMCG companies in India operate dozens of household brands: for example, HUL sells Lux soap and Rin detergent, ITC sells Aashirvaad atta and Bingo! snacks, and Godrej Consumer sells Cinthol soaps and Good Knight mosquito repellent. Each firm has an extensive distribution network (HUL reaches ~9 million outlets-livemint.com) and a trusted brand heritage. Together, FMCG brands in India generate trillions of rupees by selling everyday staples.

Wide distribution: FMCG giants leverage vast kirana (mom-and-pop) networks and modern retail. For example, HUL’s 50+ brands reach over 9 million outlets nationwide (livemint.com). Similarly, ITC and Dabur supply even remote areas.

Core categories: The most disrupted sectors are Beauty & Personal Care and Food & Beverages. HUL, Dabur and Marico dominate shampoos, soaps and edible oils, while Nestlé, Parle and Britannia rule biscuits, dairy and snacks. These companies invest heavily in R&D and advertising (HUL spent ₹6,380 crore on marketing in FY24-livemint.com).

Digital push: Traditional FMCG players are increasingly calling themselves ’consumer goods companies’, focusing on consumer insights. They are beefing up their e-commerce and digital strategies. For instance, ITC’s 2023 report highlights its own D2C platform (“ITC Store”) covering 20,000+ pincodes (entrepreneur.com).

In short, the companies in the FMCG sector in India have deep pockets and distribution, but in 2025, they face a new kind of competition from digital-native brands.

To understand how legacy brands position themselves with cultural heritage, check out our deep dive into why everyone loves FabIndia — a brand that masterfully blends tradition with modern retail strategies in India.

The Rise of D2C Disruptors in India

A few years ago, D2C brands like Mamaearth, Licious, Sugar Cosmetics or boAt were niche. Now they’re mainstream. These digitally-native brands sell directly to consumers online – no wholesalers or kiranas. They thrive on personalization, viral marketing and convenience. Several factors explain their surge: urban consumers’ thirst for novel, local and ethical products; widespread smartphone adoption; and easy online payments. For example, a report by Avendus Capital notes there are “over 80 D2C brands in India’s beauty and personal care industry”, and more are joining each year – (mordorintelligence.com). Mamaearth (skincare) and Sugar Cosmetics (makeup) have captured young buyers’ imaginations with millennial-friendly branding and free-from formulations. Food-tech D2C brands like Licious (fresh meat) and Epigamia (curd) cater to urban diet trends. In 2023, D2C sales boomed so much that Mamaearth raised ~$120–150 million to gear up for an IPO (mordorintelligence.com).

Overall, experts predict the Indian D2C market could hit $100 billion by 2025 (with ~34–40% CAGR)- (entrepreneur.com) (economictimes.indiatimes.com). The COVID-accelerated e-commerce wave was a catalyst: millions of consumers tried online shopping for the first time. Today, D2C brands are known for trendy packaging, targeted ads, subscription boxes and influencer collaborations (e.g., Nykaa, originally D2C, became a unicorn via social media buzz). Many Indian D2C companies also leverage global digital tools – for instance, brands use AI-driven chatbots on WhatsApp or Instagram shopping to engage customers. The key disruptive elements are personalization and convenience: consumers can buy niche products (say, plant-based protein powder or cosmetic sheets for Indian skin tones) from home with just a few taps. This has rattled the incumbents, forcing even century-old FMCG brands to rethink their playbook.

Speaking of D2C successes, Indian homegrown brands like boAt and Noise have rewritten the playbook with aggressive marketing and direct customer connections. Their growth stories reveal why D2C is such a compelling threat to FMCG giants.

How FMCG Brands Are Responding to D2C Threats

Legacy FMCG giants in India are not standing still. They’ve launched a slew of strategies to fight back and win younger, digital-savvy shoppers. Here are the major tactics:

- Building Their Own D2C Channels: Many FMCG companies now sell direct to consumers through branded web stores or apps. Dabur, for example, launched DaburShop, an official online outlet with its full range including Ayurvedic medicines (entrepreneur.com). Dabur’s CEO says the site will also host “digital-first” products from Dabur’s own incubator (entrepreneur.com). Likewise, ITC revamped its ITC Store platform to reach 20,000+ pincodes with brands like Aashirvaad atta and Savlon antiseptic (entrepreneur.com). These moves let FMCG firms control the customer experience and collect buying data (just like a D2C startup). It also means higher margins, since there is no middleman. However, running D2C sites poses challenges: maintaining fast delivery (they promise delivery in 24–72 hours – entrepreneur.com), pricing competitively against e-tailers, and avoiding cannibalizing retail sales.

- Acquiring or Investing in D2C Startups: An alternative is to buy growth and tech. Indian FMCG majors have been snapping up or partnering with popular startups. Marico has built a mini-empire of health and beauty D2C brands: it acquired grooming brand Beardo and organic skincare Just Herbs, and even bought majority control of food-startup True Elements (ndtvprofit.com). These brands already had loyal online followings, adding new categories to Marico’s portfolio. ITC invested in baby-care brand Mother Sparsh and is set to acquire snack brand Yoga Bar (entrepreneur.com) (ndtvprofit.com). Even Wipro Consumer launched a venture fund that backed hits like MyGlamm (cosmetics) and Ustraa (male grooming) (entrepreneur.com). These collaborations boost the big firms’ innovation (and often earn them equity stakes). The risk is integration: global companies must avoid stifling startup culture or overpaying. But done well, it’s a win-win: D2C brands get scale and distribution, and FMCG groups add fresh talent and technology.

- Omni-channel and Quick Commerce Expansion: Incumbents are leveraging new retail models rather than seeing them only as D2C territory. For example, quick commerce (ultra-fast delivery via apps like Blinkit, Zepto, Swiggy Instamart) has exploded. Parle Products (biscuit maker) reports that over half of its online sales now come through quick-delivery platforms (financialexpress.com). Dabur’s CEO says quick commerce accounts for ~30–35% of its e-commerce volume (financialexpress.com). Hindustan Unilever has doubled its product assortment on quick-commerce apps in 2024 – livemint.com. These companies tailor offerings for instant needs: smaller “grab-and-go” packs of snacks, ice creams or personal care kits are rolled out on these apps. The strategy works because speed and convenience align perfectly with impulsive buying habits, especially for staples and beauty touch-ups. The downside: margins can be thin (delivery platforms take commission) and logistics are complex. Still, embracing quick-commerce is essential – as one industry note explains, quick-commerce now makes up roughly a third of FMCG e-commerce sales (financialexpress.com).

- Quick commerce is another space FMCG giants are tapping into. For an in-depth look at this booming sector, explore our breakdown on Blinkit’s quick commerce strategy in India.

- Premiumization and Product Innovation: Many legacy brands are creating “new-age” premium lines to fight the trend. HUL, for instance, formed a Premium Retail Organization to push Lakmé cosmetics and Dove’s higher-end lines into beauty stores and pharmacies (livemint.com). It has also launched gourmet food items (e.g. “Korean Meal Pots” by Bru coffee) exclusively for e-commerce and modern trade (livemint.com). Godrej Consumer Products introduced premium body wash (Cinthol Foam) and even fragrances (Park Avenue Fine Fragrances) to tap wealthier buyers (godrejcp.com), while simultaneously offering smaller “access packs” of its core brands for rural markets (godrejcp.com). Why it works: wealthier Indian consumers are trading up, and health-conscious millennials pay extra for natural or niche items. According to Nielsen, premium segments in India’s economy have seen growth even amid rural weakness (godrejcp.com). However, premium lines can be high-risk – they require marketing and a consumer education campaign, and not all consumers will switch up. Brands must balance new products with popular mass-market items.

- Leveraging Influencers and Digital Marketing: Traditional TV ads alone won’t win over Gen Z. Large FMCG firms are investing heavily in social media and influencers. HUL famously expanded its influencer roster from 700 to 8,000 in one year (FY25) (livemint.com). It runs influencer campaigns for products across categories (e.g., Lakme, Surf Excel, Vim) to reach younger audiences. Similarly, Dabur, Marico and others sponsor YouTube tutorials, Instagram challenges and TikTok-style content. For example, Sugar Cosmetics, a D2C upstart, built its brand almost entirely online using viral videos and makeup influencers (startuptalky.com). Why it’s effective: studies show ~80% of Indian shoppers discover new products via social media, and two-thirds make purchases after seeing an Instagram Reel (livemint.com). By flooding these channels with content, FMCG brands build a trendy image and direct-to-consumer relationships. The challenge is tracking ROI and maintaining authenticity – consumers quickly tune out stale celebrity endorsements.

- Data-Driven Personalization: Big FMCG companies are using AI and data analytics to mimic D2C agility. For instance, HUL’s new “WiMI 2.0” strategy uses geo-targeting and machine learning to customize product assortment by region (livemint.com). ITC uses online quizzes (e.g. its fragrance “Finder”) and nutrition customizers (Aashirvaad Meri Chakki) to tailor products to consumer preferences. Advanced tools help optimize pricing and inventory. Unilever globally has even deployed generative AI to create product descriptions, and Nestlé to validate new recipe ideas (kanvic.com). By harnessing consumer data from online sales and apps, FMCG players aim to offer personalized bundles, subscription plans, or targeted coupons – a hallmark of D2C playbooks. The risk lies in data privacy and over-reliance on technology; still, those who succeed can build stronger customer loyalty.

- Modernizing Distribution and Retail Tech: Rather than ignore kiranas, FMCG firms are digitizing them. HUL launched the Shikhar app for Kirana stores and integrated it with India’s Open Network for Digital Commerce (ONDC) – livemint.com. Now neighbourhood shops can quickly go online, order inventory, and even sell to consumers over ONDC, with HUL’s support. Similarly, companies are installing analytics in modern trade stores and partnering with grocery tech firms. On the policy front, many collaborate with the government’s PLI scheme (for local production) or ONDC to reshape retail infrastructure. This omnichannel overhaul ensures FMCG brands maintain dominance across offline and online – crucial when, for example, rural India (36% of FMCG spend – maximizemarketresearch.com) starts shopping on smartphones in greater numbers. The main challenge is change management: training millions of small retailers on apps and balancing investment between old and new channels.

Each of these tactics shows that big FMCG companies in India are borrowing from the D2C playbook – from influencer gigs to fast delivery partnerships – while leveraging their scale. By 2025, they are essentially becoming omnichannel consumer companies. However, the competition is fierce, and legacy brands must carefully avoid eroding their core business or getting outsmarted by even newer startups.

Case Studies: Parle, Godrej Consumer & Sugar Cosmetics

Parle Products (FMCG): Parle, India’s iconic biscuit and snack maker, provides a clear example of an FMCG giant adapting. When online groceries exploded in 2023–24, Parle quickly partnered with all major quick-commerce apps. Today, over 50% of Parle’s e-commerce sales come from quick commerce platforms (financialexpress.com). Parle introduced single-serve and multi-serve biscuit packs tailored for these apps, and it works closely with apps like Zepto and Blinkit on special “Parle-only” promotions. Parle also sells directly via its own website and Amazon, focusing on regional flavors (gluten-free atta biscuits, millet cookies) to stand out. These moves paid off: Parle regained volume growth as offline demand slowed. A risk Parle faces is tighter margins on these instant channels and reliance on the platforms’ logistics.

Godrej Consumer Products (FMCG): Godrej CP (makers of Cinthol, Good Knight, Godrej No.1 soaps) took a two-pronged approach. First, it deepened distribution in rural India. Through “Project Vistaar,” Godrej doubled its village-level coverage and tripled rural outlets in a year (godrejcp.com). It also launched smaller, low-cost packs of shampoo, soap and mosquito repellent to make products affordable in smaller towns. Second, GCPL embraced e‑commerce: it ramped up presence on Amazon/Flipkart and partnered with quick commerce in metros (the 2024 report notes it “rapidly increased presence across e-commerce including quick commerce” – godrejcp.com). Simultaneously, Godrej targeted premium urban buyers by releasing higher-end products (e.g. Cinthol Foam body wash, and even a new fragrances line) – godrejcp.com. The outcome: while rural volume steadied, Godrej’s overall sales grew steadily in FY24, aided by premiumization and online channels. One downside is complexity – managing such diverse channel strategies requires careful coordination and inevitably raises costs.

Sugar Cosmetics (D2C): By contrast, Sugar Cosmetics is a homegrown D2C success story now venturing into FMCG territory. Founded in 2015, Sugar sells cruelty-free makeup and skincare. Its strategy has been pure digital and experiential marketing. It built a strong online community on Instagram and YouTube using micro-influencers and viral tutorials (startuptalky.com). Sugar ensured omnichannel reach: it’s sold on its own website and marketplaces (Nykaa, Amazon), and it set up 300+ exclusive stores and shop-in-shops in lifestyle outlets (startuptalky.com). The brand’s appeal lies in trendy products at mid-range prices and fun engagement (e.g. interactive polls, flash sales). The outcome: Sugar quickly captured urban youth, outpacing older cosmetics brands in online traction. It went on Shark Tank India, cementing its image. Sugar’s model shows why FMCG incumbents pay attention: it achieves in 5 years what traditional brands do in decades. Today, HUL and others have acquired cosmetic startups, partly to neutralize brands like Sugar.

Comparison: These case studies highlight the contrast: Parle and Godrej leveraged scale and distribution to respond (focus on channels and packs), whereas Sugar built its brand with content and community from the ground up. Parle/Godrej improved availability (everywhere from kiranas to quick delivery) and diversified offerings; Sugar innovated on engagement (talking directly to customers online). Both approaches have merits. Customers, ultimately, benefit from more choices – whether it’s the latest Masala Marie from Parle delivered in 10 minutes, a Godrej soap tailored for rural pockets, or a Sugar Cosmetics lipstick that’s cruelty-free.

Similarly, in other industries, Samsung’s India success story and Mahindra’s marketing evolution show how legacy players can stay relevant amidst fierce competition.

Indian Market Analysis: FMCG & D2C Growth in 2025

India’s macro numbers underscore this competition. The FMCG sector continues to grow healthily. As one market report notes, the industry was up ~6–7% in value in 2024, driven by new product innovations and rural demand resurgence (maximizemarketresearch.com). E‑commerce is a fast-growing sales channel: it accounts for about 7–10% of total FMCG sales today (financialexpress.com), and projections suggest this could reach ~11% by 2030 (kanvic.com). D2C brands form a smaller slice (as of 2023, maybe 2–3% of the market), but they’re expanding rapidly. Analysts forecast India’s overall D2C e-commerce to be around $60–100 billion by 2027 (economictimes.indiatimes.com) (entrepreneur.com), which would rival the legacy players in fast-growing niche categories like organic foods and personal care. Meanwhile, the rural FMCG market (about 36% of spendingmaximizemarketresearch.com) is bouncing back as incomes rise, and even here D2C is making inroads thanks to better internet access.

In this quick analysis, industry experts break down the key forces shaping India’s FMCG sector in FY25 — from digital transformation and premiumisation to the aggressive D2C playbook.

Platform-wise, Amazon and Flipkart remain e-tail kings, but Indian ventures like JioMart and BigBasket (BB Now) are gaining. Government initiatives like ONDC (Open Network for Digital Commerce) aim to democratize online selling, potentially giving kiranas a cut of e-commerce. With India’s middle class expected to double by 2030 and internet penetration going above 900 million users (kanvic.com), both FMCG giants and D2C startups have massive headroom. The overall Indian FMCG market is projected to reach $300+ billion by 2030 (pacerecruit.com), split between traditional and digital channels – a healthy pie for all players, provided they adapt to changing Indian consumer behavior.

Beyond FMCG, Indian industries like aviation and fitness & whey protein markets are experiencing similar disruptive trends. These insights help contextualize broader consumer shifts in India.

Shifts in Indian Consumer Behavior

Several clear trends in consumer behavior are shaping the battleground:

- Digital First and Social: More Indians are shopping and researching online than ever. Roughly 80% of shoppers discover new brands via social media, and about two-thirds purchase after seeing an Instagram Reel (livemint.com). By 2035, Gen Z and Millennials are expected to drive half of India’s consumer spending (livemint.com). Younger buyers demand authenticity and engagement (user-generated reviews, TikTok challenges, etc.). As a result, FMCG companies have shifted big parts of their advertising budget to YouTube, Instagram and influencer tie-ups (livemint.com) (livemint.com).

- Health, Wellness and Sustainability: Post-pandemic, Indian consumers are more health-conscious. Demand for immune-boosting foods (millets, fortified staples) and natural personal care (chemical-free, ayurvedic products) is surging. For instance, brands like Dabur have expanded their organic ranges and Ayurvedic offerings. Equally, eco-friendly packaging and cruelty-free formulations are becoming purchase drivers. A market study notes customers are increasingly “prioritizing sustainable solutions over quick fixes” (mordorintelligence.com). Major FMCG companies have taken note: HUL and ITC, for example, commit to recyclable packaging and invest in green product lines. Global concerns (plastic waste, carbon footprint) are filtering down to India’s urban consumers.

- Omnichannel Shopping Habits: Even traditional rural shoppers are online more. Today, 53% of new internet users are in rural India (kanvic.com). Many Tier-2/3 consumers now buy groceries and personal care products via WhatsApp catalogs or local apps. Nevertheless, offline still matters: over 70% of FMCG sales happen through kiranas and small stores (financialexpress.com). The savvy brands are unifying these worlds. For example, a housewife in Lucknow might browse product info on YouTube, ask a local store to order it through ONDC, and pay with a UPI QR scan – a blend of old and new. This digital-physical crossover is a hallmark of 2025’s Indian buyer.

- Value and Premium Mix: Inflationary pressures mean value packs and promotions still attract many shoppers, especially in rural areas. Godrej’s “access packs” and Parle’s small portion packs cater to this thriftiness (godrejcp.com) (godrejcp.com). Meanwhile, an expanding middle class is also willing to pay extra for premium or imported-style products. Both trends mean consumers expect choice. FMCG brands must balance value (large volumes, discounts) with premium (natural ingredients, prestige) to keep loyalty.

- Cultural and Regional Tastes: Indian consumer behavior is highly region-specific. Brands that localize do well: e.g. Dabur offering mustard oil in the north but rice bran oil in the south. D2C brands, with their targeted marketing, often niche down to specific communities (a probiotic drink for fitness enthusiasts, or a skincare line for dark skin tones). Established FMCGs are trying to mirror this by hyperlocal R&D and regional marketing as part of their “Winning in Many Indias” strategy (livemint.com).

In essence, Indian consumers in 2025 are more informed, demanding and fickle than ever. They want products and experiences that fit their individual needs – whether that means home delivery in Bangalore, a TikTok tutorial in Vadodara, or an ayurvedic soap made in Kerala. FMCG firms must stay close to these shifts or risk being outflanked by nimble D2C upstarts.

The evolving Indian consumer isn’t just reshaping FMCG; brands like Tanishq in jewelry and Haldiram in F&B are adapting to changing tastes and digital engagement trends too.

What’s Next: Future Trends and Predictions

Looking ahead to 2030 and beyond, several trends will shape the Indian FMCG–D2C landscape:

- AI-Driven Personalization: Brands will increasingly use artificial intelligence to customize everything. For example, Unilever is already using AI to auto-generate product descriptions for digital channels, and Nestlé uses AI to predict food trends (kanvic.com). Soon, consumers might get personalized product recommendations based on their health data or purchase history. FMCG companies will leverage gen-AI to speed up product development (imagining new flavors or formulas) and to craft hyper-targeted marketing.

- Sustainability as Standard: Environmental concerns will become even more central. By 2030, expect a majority of FMCG packaging to be recycled or compostable. Many brands (global and Indian) have set 2025–2030 goals for carbon-neutral factories and plastic reduction. We’ll see more fruit and vegetables sold without plastic, refill stations for detergents, and start-ups offering zero-waste home deliveries. Consumer loyalty will favor green brands: those that can prove their supply chains are ethical and eco-friendly. Regulatory pressure may also enforce eco-standards, which could reshape supply chains.

- Digital Commerce Evolves: E-commerce will keep expanding its share of sales. Nielsen and Kanvic Consulting predict online FMCG could rise to ~11% of total by 2030 (kanvic.com) (vs ~3% today). In practice, this means the war for “e-shelf” space (top-of-search on Amazon/Flipkart) will intensify. New models like livestream shopping, voice ordering (via assistants like Alexa), and social commerce (buying directly through Instagram) will mature. ONDC or similar open networks might make it easier for small kiranas to sell online across platforms. Quick commerce could reach tier-2 towns. Offline players will counter with tech (self-checkout shops, contactless payments, automated micro-stores).

- Health and Niche Markets: We’ll see more D2C-style innovation in segments like pet food, personalized vitamins, ethnic snacks, and natural personal care. The Internet allows targeting very narrow consumer segments profitably. For instance, a startup might sell probiotic lassi subscriptions or eco-friendly menstrual products nationwide. Legacy FMCGs are likely to either incubate or buy these startups. Premium snacks, plant-based meat, regional cuisines, and superfoods (millets, flaxseed) are likely growth drivers.

- Consumer Data & Privacy: As more shopping goes online, data will be king – but also a concern. Companies will build detailed consumer profiles to customize offers (differential pricing by region, ads). At the same time, India may introduce stricter data privacy laws. Brands will need to balance personalization with transparency. Trust and brand safety will become premium qualities.

- Global D2C Influence: Indian consumers will increasingly adopt global D2C trends. International brands (e.g., halal cosmetics, African skincare, Korean snacks) available via online stores will influence local tastes. Conversely, some Indian D2C brands may expand globally (we see early signs with brands like Amway-Wipro’s new products abroad).

- Tech Innovations: Look for AR/VR in FMCG (try-before-you-buy apps, virtual home care demos), blockchain for supply-chain transparency (scannable codes to verify organic or fair-trade claims), and even drone deliveries in a few hotspots. Voice commerce (ordering FMCG via voice assistants) could carve a niche among busy professionals.

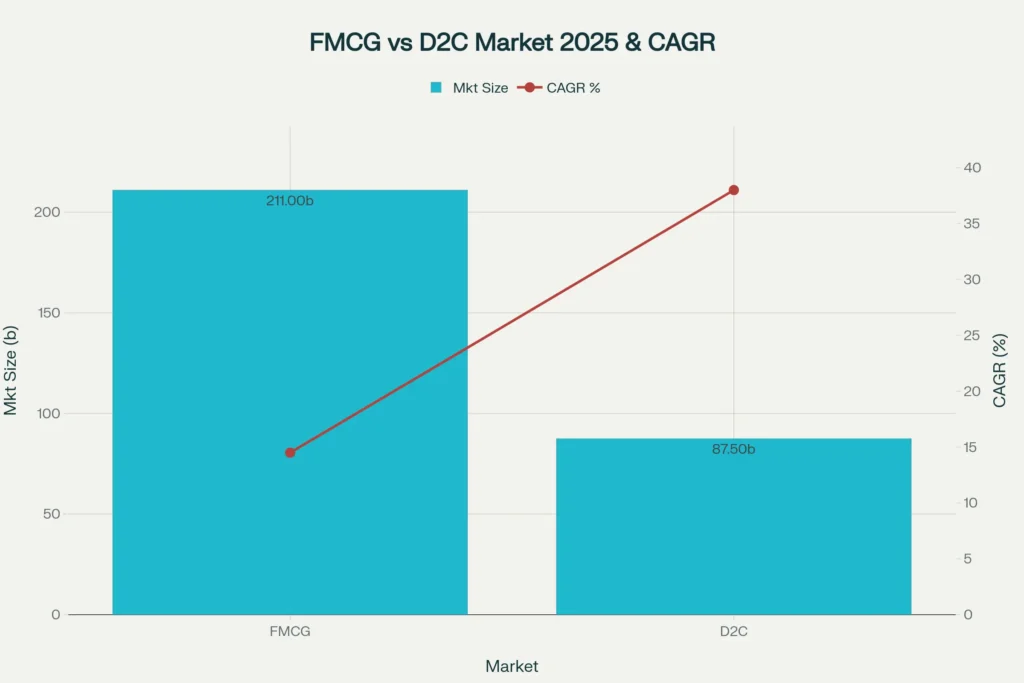

Projected market size and growth rates of India’s FMCG vs. D2C segments in 2025.

This growth disparity vividly illustrates where the future momentum lies. Although FMCG brands in India remain massive in scale, the D2C sector’s staggering 38% growth rate signals a dynamic shift driven by digital adoption, personalized offerings, and evolving consumer expectations.

By 2030, expect this gap to narrow as big FMCG companies in India continue to invest in D2C-like agility, AI-powered personalization, and sustainability-led innovation.

Overall, the Indian market analysis points to an evolving hybrid landscape: by 2030, traditional FMCG giants and D2C brands will likely co-exist in a more integrated ecosystem. Giants will act nimbly (through separate digital arms or partnerships) while D2C brands may broaden into retail. The biggest winners will be those combining scale and agility – for example, a big company using AI insights to launch a viral D2C line overnight.

For broader innovation trends in India, don’t miss our take on Micro SaaS expansion and startup growth hacks for 2025 — both are redefining how brands think about scale and agility.

Conclusion: India’s FMCG giants are at an inflection point. The entry of D2C competitors has spurred a strategic overhaul – from e-commerce expansion to influencer blitz and product premiumization. As a result, many Indian consumers now enjoy unprecedented choice and convenience. Key takeaways: legacy FMCG brands in India must embrace digital distribution, data analytics, and customer engagement to stay relevant. The battle is far from over – we expect the next 5 years to see even more collaboration (M&A, co-branded products) and innovation. For readers intrigued by this transformation: keep watching the FMCG and D2C space. Follow brands like HUL, ITC or Dabur (and rising stars like Sugar Cosmetics) on social media, and pay attention to new campaigns. Studying these trends can teach valuable lessons in marketing and consumer behavior.

What new FMCG or D2C product has caught your eye lately? Let us know your thoughts, and stay tuned as India’s consumer market story unfolds!

Sources

- Economic Times – Indian D2C Brand Market Poised to Hit $61.3 Billion by FY27

- Maximize Market Research – Indian FMCG Market Size and Growth Forecast

- Entrepreneur India – Why FMCG Giants are Adding D2C to Their Strategy

- LiveMint – HUL’s Quick Commerce and Premium Brand Strategy (2024)

- LiveMint – HUL’s Influencer Partnerships and Creator Economy

- Mordor Intelligence – India D2C E-Commerce Market Report

- NDTV Profit – Marico CEO on Digital-First Brand Profitability by 2027

- Financial Express – Q-Commerce Sales for FMCG Majors Double in a Year

- Godrej Consumer Products – Strategic Pillars and Access Packs Strategy

- StartupTalky – Sugar Cosmetics Marketing Strategy via Influencer Marketing

- Kanvic Consulting – 8 Trends Shaping FMCG Industry in India