Introduction To Haldiram Brand Strategy

In 1937, Ganga Bishan Agarwal, fondly known as Haldiram Ji, opened a modest namkeen shop in Bikaner, Rajasthan. His signature bhujia, a crispy snack made from moth flour, quickly gained popularity, setting the stage for what would become one of India’s most iconic snack brands. These days, everyone knows Haldiram’s. It has a huge presence in more than 80 countries around the world and has over 40% of the organized namkeen market in India. This blog talks about Haldiram’s amazing journey, including its growth strategies, product diversification, and market dominance. Students, young professionals, and marketers who are interested in Indian business success stories will find it useful.

Image: Haldiram started off their journey with this shop

Business Evolution

Product Range

Haldiram’s began with its now-famous bhujia but didn’t stop there. Over the decades, it expanded its portfolio to include a wide array of traditional Indian snacks like sev and moong dal, as well as sweets such as rasgulla and gulab jamun. By the 1990s, the company ventured into western snacks, cookies, sherbets, pickles, and even frozen foods like samosas and ready-to-eat meals. Since Haldiram’s has more than 410 products, it can meet the needs of a wide range of customers and stay relevant in a market that is always changing. This diversification has been key to its growth, allowing it to appeal to both traditionalists and modern consumers seeking convenience.

Just as Samsung’s product ecosystem strengthens its market presence, Haldiram’s 400+ SKUs allow it to dominate the Indian snack landscape.

Geographic Expansion

Haldiram’s growth wasn’t only in the products it sold. The brand carefully grew its presence in India and other countries. It started in Bikaner and built its first factory in Kolkata. In 1970, it built a bigger factory in Jaipur. In the early 1990s, a factory was built in New Delhi, and operations in Nagpur made its presence even stronger. Each unit made products that fit the tastes of the people in that area, so they were popular there and could be sold all over the country. Haldiram’s began exporting in 1993, starting with the US. Today, its products are sold in more than 80 countries, including the UK, Japan, and Australia.

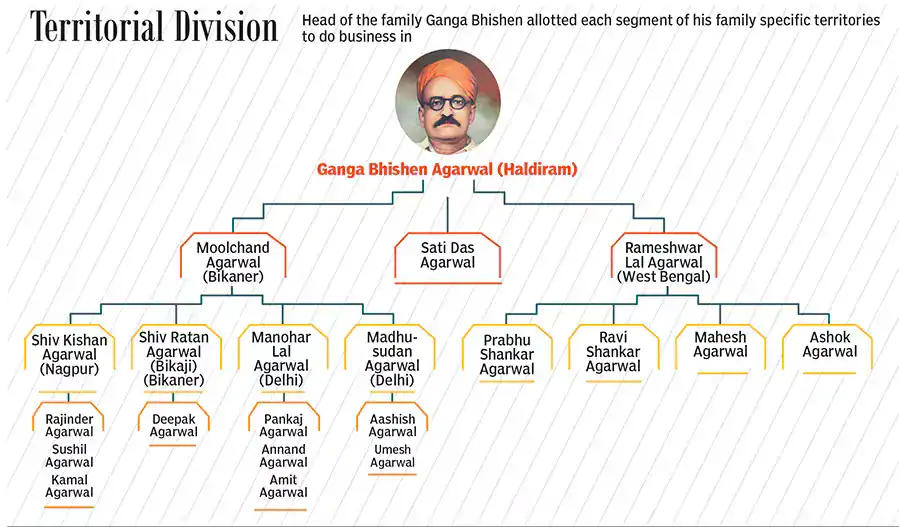

Family Split

Haldiram’s, like many family-owned businesses, had problems within the company. The Agarwal family broke up in the 1960s, and now different branches in Kolkata, Delhi, and Nagpur run their businesses. Haldiram Bhujiawala and Haldiram’s Prabhuji run the business in Kolkata. Manohar Lal, Madhusudan, and Shiv Kishan Agarwal run the business in Delhi and Nagpur, respectively. Even though there have been legal fights over the brand name, each company has kept Haldiram’s reputation for quality, which has helped it succeed. The Delhi and Nagpur units came together in 2022 to form Haldiram Snacks Food Pvt. Ltd., which made the company stronger in the market.

Branding and Marketing Moves

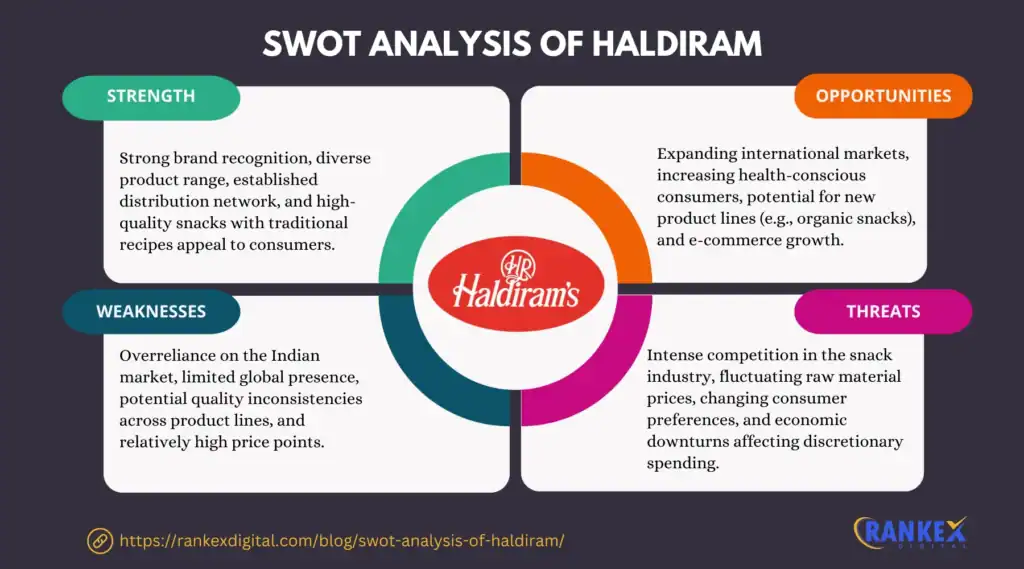

Through smart marketing and branding, Haldiram’s has built a strong brand. Its main strength is its dedication to quality and authenticity, which is shown in the use of traditional recipes and high-quality ingredients. This has built a lot of trust and loyalty among customers, which makes Haldiram’s the brand of choice for Indian snacks.

Fabindia’s timeless brand appeal also shows how staying true to heritage can build long-lasting customer trust.

The new packaging has helped. Haldiram’s was one of the first companies to use modern packaging methods like zip pouch bags and standee pouches, which make products last longer and look better. Packaging filled with nitrogen keeps things fresh, which is good for both domestic and international customers.

The brand’s distribution network is another important part of its success. Haldiram’s makes sure that its products are easy to find in both cities and rural areas by having 1,000 distributors and products available in more than 7 million stores around the world. Its restaurants, which also have stores, make it even more popular. Haldiram’s also uses its Bikaner heritage to connect the brand with real Rajasthani flavours, which customers really like.

Some of the most important marketing efforts are partnerships, like the one with Indian Railways, and product placements, like the movie Prem Ratan Dhan Payo in 2015, where over 1.5 crore snack packets had the movie’s logo on them. Haldiram’s doesn’t use as much aggressive advertising as its competitors do, but its focus on quality and tradition has worked.

Haldiram’s has also used pop culture partnerships as part of its current branding strategy. For example, this bright summer ad with Labubu promotes their Thanda-Funda beverage collection. It has a fun, young, and seasonal feel that fits with the brand’s changing voice for Gen Z and city dwellers.

Market Leadership Analysis

Haldiram’s commands over 40% of the organized Indian namkeen market, which makes a proof of its dominance in the $6.2 billion savory snacks sector. In FY24, the company reported revenues of approximately ₹12,800 crore, surpassing PepsiCo’s snack business in India, which earned ₹4,763 crore from April to December 2023. Several factors underpin this leadership:

- Taste: Haldiram’s consistent quality and authentic flavors, rooted in traditional recipes, keep consumers coming back.

- Trust: Decades of maintaining hygiene and quality standards have built a loyal customer base.

- Scale: Multiple manufacturing plants in cities like Kolkata, Jaipur, Nagpur, and New Delhi, coupled with a vast distribution network, ensure widespread availability.

- Innovation: Continuous product diversification, such as introducing frozen foods and western snacks, keeps Haldiram’s relevant.

In 2017, Haldiram’s reclaimed the title of India’s largest snack company, taking over PepsiCo with sales of ₹4,225 crore compared to PepsiCo’s ₹3,991 crore. Its growth rate of nearly 30% outpaced the industry’s 17%, pointing out its competitive edge.

Unlike brands like boAt, which rely on influencer-heavy marketing, Haldiram focuses on distribution, packaging, and heritage.

Competitor Comparison

Haldiram’s faces competition from both regional and global players. Bikaji Foods, founded in 1993 by Shiv Ratan Agarwal, a grandson of Haldiram Ji, holds a 9% market share, centred on snacks like bhujia and papad, with strength in Rajasthan, Assam, and Bihar. Even though Bikaji is a strong contender, Haldiram’s broader product range and national presence give it an edge.

PepsiCo, with brands like Lay’s and Kurkure, leads the western snacks segment with a 24% market share but lags in traditional snacks, where Haldiram’s excels. In FY24, Haldiram’s revenue was more than double PepsiCo’s snack sales in India, underscoring its dominance in the ethnic snacks category. Other competitors like ITC (Bingo) and Balaji Wafers challenge Haldiram’s, but its deep-rooted authenticity and scale keep it ahead.

Competitor | Market Share (Snacks) | Strengths | Weaknesses |

|---|---|---|---|

| Haldiram’s | >40% (Namkeen) | Authenticity, scale, global reach | Limited advertising, weaker in South India |

| Bikaji | 9% | Strong in specific regions, quality | Smaller scale, less diversified |

| PepsiCo | 24% (Western Snacks) | Global brand, marketing strength | Limited presence in ethnic snacks |

Global Presence and Modern Retail

Haldiram’s global footprint is impressive, with exports to over 80 countries, including the US, UK, Japan, Australia, and the UAE. It began exporting in 1993, initially to the US with 15 savory products, and opened its first overseas factory in the UK in 2016 to serve the European market. This global reach caters to the Indian diaspora and growing international demand for Indian cuisine.

In India, Haldiram’s operates over 150 outlets, which include retail and restaurant services. Its products are available in over 7 million outlets worldwide, supported by a network of 1,000 distributors. The brand has also embraced modern retail, offering goods through its official website and e-commerce platforms like Amazon and Flipkart, to guarantee accessibility to a global audience.

Like quick-commerce platforms analyzed in Blinkit’s evolution, Haldiram’s retail presence extends from offline stores to digital convenience.

Recent developments, such as a 2024 attempt to acquire a majority stake in Prataap Snacks for $350 million, indicate Haldiram’s ambition to improve its position in the potato chip market. Likewise, interest from global investors like Temasek and Blackstone, with a valuation of ₹85,000-90,000 crore, shows its attractiveness as a global brand.

This video covers the Haldiram success story in detail

Conclusion

Haldiram’s journey from a small Bikaner shop to a global snack giant offers valuable lessons for startups and marketers:

- Commitment to Quality: High standards build trust and loyalty, as seen in Haldiram’s consistent quality.

- Product Diversification: Expanding from namkeens to frozen foods and western snacks broadened its market.

- Innovative Packaging: Modern packaging like zip pouches improves shelf life and brand appeal.

- Strong Distribution Network: A vast network ensures products reach every corner, domestically and globally.

- Leveraging Brand Heritage: Haldiram’s Bikaner roots create an emotional connection with consumers.

- Global Expansion: Exporting to over 80 countries and establishing overseas factories boosted growth.

- Adapting to Trends: Introducing convenience foods and embracing e-commerce keeps the brand relevant.

Haldiram’s story is a testament to how a family business can achieve global success through quality, innovation, and strategic vision. As it continues to grow, its ability to balance tradition with modernity will inspire aspiring entrepreneurs and marketers.

From Mahindra’s rise as a rooted Indian brand to Haldiram’s scale, legacy and emotion play a big role in consumer trust.

Citations:

Sources

- Wikipedia – Haldiram’s – Overview of brand history, regional split, and market presence.

- StartupTalky – Haldiram’s Success Story – Brand journey, product expansion, and revenue growth.

- Business Standard – From Bhujia to Snack Empire – Business evolution and brand milestones.

- Financial Express – Ganga Bishan Agarwal’s Legacy – Founder’s background and family legacy in business.

- CNBC TV18 – IPO and Family Split – Details on IPO buzz and regional family-run units.

- Marketing Monk – Haldiram’s 38.5% Market Share – Insights into leadership position in India’s snack market.

- Markitome – How Haldiram’s Dominates Indian Snacks – Product strategies, consumer behavior, and brand presence.