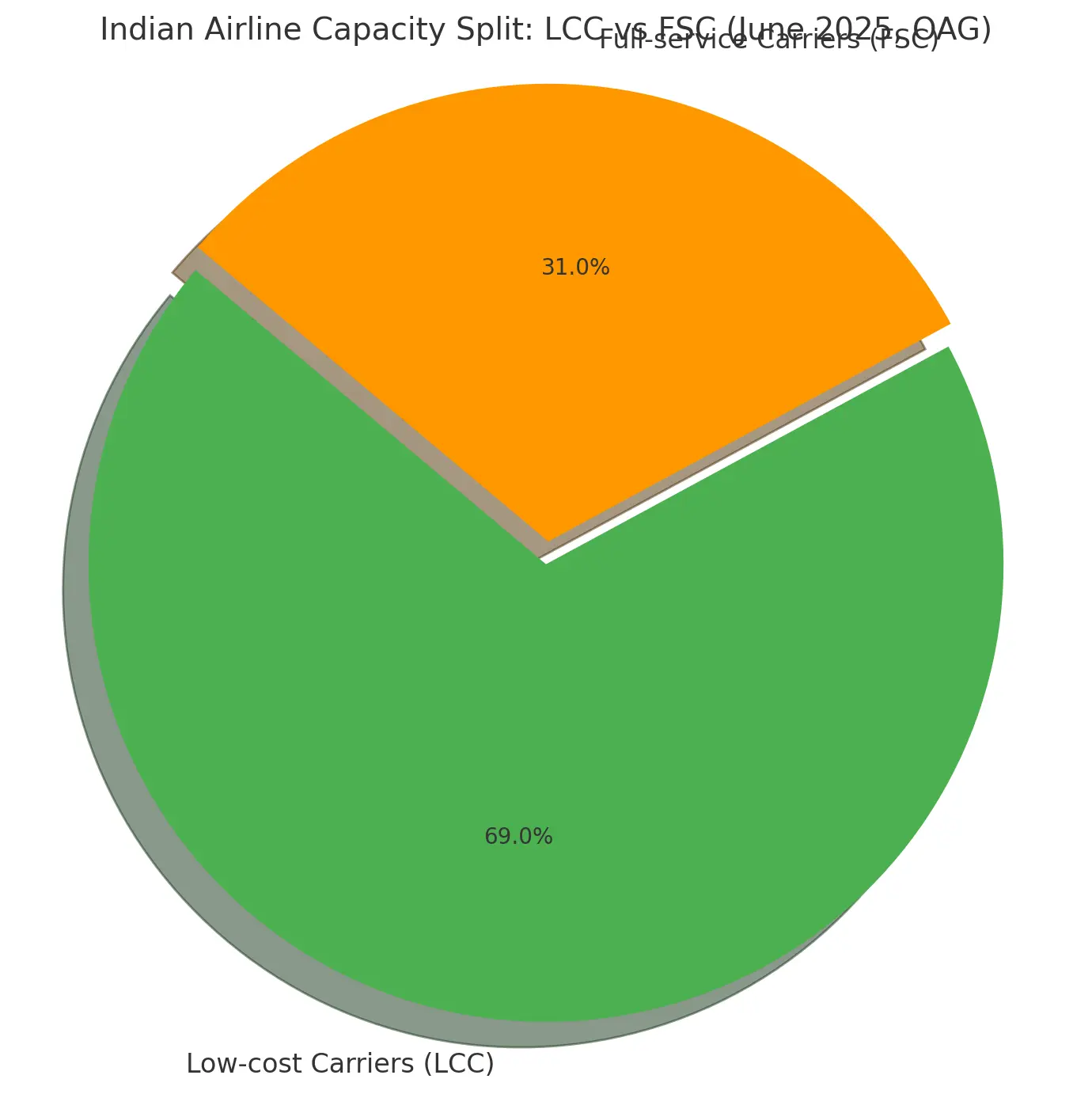

Pie Chart:

Domestic vs international airline capacity (June 2025, OAG). Indian Aviation Market has rapidly rebounded: domestic carriers flew ~161.3 million passengers in 2024, a 6.1% rise over 2023. Low-cost carriers (LCCs) dominate – OAG data show 69% of Indian capacity is LCC, only 31% full-service – reflecting a price-driven market. IndiGo alone carried ~99.9 million domestic fliers in 2024 (61.9% share), far outstripping other airlines. In contrast, the merged Air India Group (Air India, Vistara, etc.) accounted for roughly 28% of 2024 domestic traffic. Over the last decade IndiGo grew from about 32% to ~62% of India’s capacity, effectively creating a duopoly (IndiGo + Tata-run Air India group had ~81% of 2023 traffic).

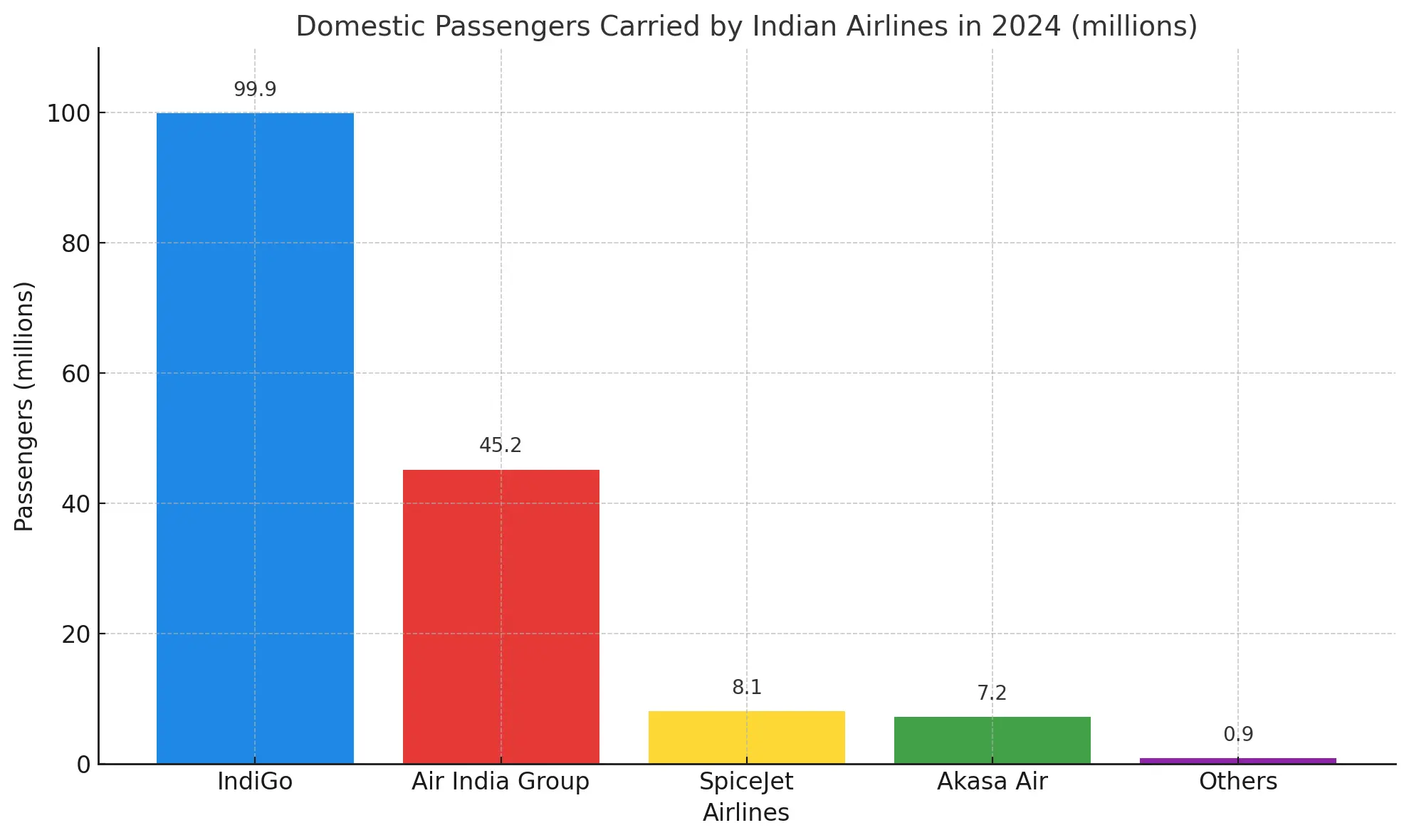

Bar Graph:

Domestic passengers carried by key Indian airlines in 2024 (millions). This breakdown (DGCA data) highlights the gap: IndiGo (~100M) versus all others. The trend reinforces that India’s aviation is driven by scale and efficiency – a handful of large carriers covering most routes. These shares are underpinned by India’s UDAN regional scheme and rising middle-class travel demand. Industry analysts emphasize that LCCs (IndiGo, Akasa, SpiceJet) serve price-sensitive mass segments, while full-service carriers (Air India, Vistara) target premium and business travelers. (For context, IndiGo was ranked 15th-most punctual globally in 2022, a reliability point it heavily promotes.)

Budget vs. Premium Positioning

In the Indian Aviation Market, the airlines fall into two broad camps:

- Budget carriers (IndiGo, Akasa Air, SpiceJet) pitch low fares, simple service and efficiency. IndiGo’s branding revolves around a bright blue scheme and the promise of punctuality (“on time, every time”), with minimal frills in economy class. Newer Akasa Air (launched 2022) adopts a modern “It’s Your Sky” slogan, vibrant orange-purple colors and a message of inclusivity to appeal to younger travellers. SpiceJet (red-liveried) long used the catchy “Red. Hot. Spice.” slogan, leaning on quirky ads and aggressive discounts, though its recent safety/financial woes have hurt its image.

- Premium carriers leverage legacy and service. Vistara (Tata–Singapore Air JV) built its brand on luxury and comfort (“Fly the new feeling”), offering multi-class cabins and Indian hospitality aimed at business/leisure travelers. Air India – India’s flag carrier – is undergoing a Tata-led makeover. Its new identity (unveiled mid-2023) revives the Maharaja icon and even a patriotic sonic logo, “India Takes Flight”. Marketing for Air India emphasizes national pride and a world-class experience (new uniforms by Manish Malhotra, new livery, lie-flat seats in business class). By contrast with LCCs, these FSCs highlight premium lounges, alliances (oneworld), and full-service amenities.

Branding & Campaign Tactics by Airline In The Indian Aviation Market

- IndiGo (InterGlobe Aviation) – Uses clean, friendly branding. Ads and social media stress reliability and hassle-free travel (the casual tagline “on-time is a wonderful thing” is widely echoed). The airline rarely splurges on glitzy campaigns; instead, it focuses on frequent network announcements and minimalistic ads. Digital tools (mobile app, e-gates) reinforce the “easy travel” image. IndiGo runs a basic loyalty scheme (6E Rewards) tied to credit-card partners, but its core appeal is simple: “lowest fares + high frequency + a smile.”

- Akasa Air Positioned as India’s hip ULCC (ultra-low-cost carrier). From launch, it stressed a youthful, optimistic vibe. Its logo (“The Rising A”) and tagline, “It’s Your Sky” were rolled out in a splashy campaign. Akasa’s ads feature bright colors, a dash of Bollywood-style music, and messages of Indian dreams taking flight. Marketing leans heavily on social media and influencers, targeting millennials and first-time flyers. Its in-flight product – rainbow-hued interiors, mood lighting – reinforces the energetic brand. Akasa’s (paid) Club Akasa membership mimics a prepaid card with travel perks, aiming to build loyalty among budget travelers.

- Air India

Undertaking a massive rebrand. Marketing now blends nostalgia with modern flair. Campaigns often invoke heritage (the old Air India logo, “Maharaja” character) but with a bold new feel. For example, in 2024, Air India launched “India Takes Flight” – a Grammy-level sonic branding by Shankar Mahadevan. They have celebrated India’s diversity and pride in ads and new safety videos featuring celebrities. The airline touts its expanding long-haul network (A350s to London, USA) and revamped service (new premium seats, on-board WiFi). Frequent flyers get Flying Returns points – soon to be merged with Vistara’s program – that reinforces its pan-India focus. - Vistara

Pre-merger, Vistara’s branding emphasized “elevated” travel. Its ads and OOH (airport posters, in-flight magazine) conveyed elegance and joy: festive Diwali journeys, weddings, milestones. Taglines like “Fly the new feeling” captured its promise of fresh, prideful flying. Marketing leaned on the Singapore Airlines association to assure quality. Engagement tactics included partnerships with premium hotels and credit cards, and a strong cabin-crew identity (stylish uniforms, concierge services). Vistara’s Club Vistara FFP targeted business travelers with bonus miles campaigns and tiered benefits. - Spicejet

Known for a brash, red-on-red identity. It ran tongue-in-cheek ads (“Time to Spice up your life!”) and flash sales. SpiceJet pioneered gimmicks like online seat auctions and on-board merchandise carts. It used cartoon mascots (SpiceMoji) and tie-ups (with cartoon movies, sports events) to stay visible. However, brand consistency suffered during operational crises. Its marketing highlights (often via social memes) now focus on recovering reliability, and it still promotes “SpiceMax” premium seating for added comfort, to differentiate within the budget segment.

Customer Engagement & Loyalty

All airlines invest in digital/mobile engagement. Websites and apps are central: fare sales alerts (email/SMS), easy e-ticketing and mobile check-in, and 24×7 chatbots. On social media, airlines personify their brands (for example, IndiGo’s Twitter often quips in Hindi/English, building relatability). Co-brand credit cards (e.g., Vistara-Citi, IndiGo-SBI) drive loyalty: members earn points on flights and everyday spending. Frequent-flyer programs differ in scope – IndiGo’s 6E Rewards is straightforward, while Flying Returns (Air India) and Club Vistara are being combined into a unified “Tata One” FFP. Bundled promotions (e.g, flight+hotel deals) and partnerships with rail/bus services also extend reach. Loyalty aside, airlines focus on service recovery campaigns (offering vouchers or giveaways for delays) and post-flight feedback loops to keep customers engaged.

Comparison Of Major Airlines in The Indian Aviation Market

| Airline | Type | Tagline / USP | Loyalty Program | Brand Focus |

|---|---|---|---|---|

| IndiGo | Low-cost carrier | “On time, every time” | 6E Rewards (via GoWings) | Extensive network + punctuality; simple, friendly blue branding. |

| Air India | Full-service carrier (flagship) | “There is an air about India” | Maharaja Club | Heritage Maharaja logo; patriotic, premium image; global alliances. |

| Vistara | Full-service carrier | “Fly the new feeling” | Club Vistara | Luxurious service (SIA-backed); emphasis on experience and comfort. |

| Akasa Air | Ultra-LCC | “It’s Your Sky” | Club Akasa (paid club) | Youthful, inclusive brand; colorful design and tech-driven convenience. |

| SpiceJet | Low-cost carrier | “Red. Hot. Spice.” | SpiceClub | Bold red visual identity; value focus with quirky promotions. |

Each airline tailors its marketing to its market segment. For example, IndiGo highlights service reliability and value, while Air India/Vistara emphasize indulgence and heritage. Akasa markets itself as a modern, aspirational alternative within the budget space.

Airline Marketing Funnel & Segmentation

Airlines typically follow the classic funnel: Awareness (advertising, PR, social posts) → Interest/Consideration (website reviews, comparison tools) → Purchase (booking engines, price promotions) → Loyalty/Advocacy (FFPs, newsletters, social engagement). For example, a campaign might run TV ads or social videos to boost brand awareness, then redirect viewers to the booking site via special promo codes. Retention efforts include personalized offers (e.g. pre-filled upgrades to high-mileage customers) and reminders to redeem points.

Customer segmentation is also key. Budget airlines target young professionals, students, and families traveling domestically, often using emotional, relatable messaging. Premium carriers segment more towards business travelers, NRI/expat segments, and affluent leisure. These groups are courted with different campaigns – for instance, Air India’s digital ads in the US or Middle East emphasize direct routes to India, while IndiGo’s OOH ads in Tier-2 cities tout new regional flights. Understanding these segments helps airlines allocate marketing spend (e.g. flight + hotel bundles for vacationers, corporate tie-ups for businesses).

Summary: India’s airlines now invest in both timeless branding (logo, tagline, service promise) and dynamic marketing (digital campaigns, loyalty integrations). Low-cost brands compete on clarity and price, while full-service brands sell an experience or identity. Industry watchers note that with IndiGo’s ~60–65% share and the Tata-led Air India aiming ~30%, most of India’s traffic will continue to revolve around these dueling brands. For marketing professionals, this means opportunities in niche positioning (like Akasa’s new ULCC angle) and challenges in standing out – every airline is sharpening its digital presence, loyalty perks, and customer touchpoints.

💪 Curious about how another booming market is evolving in India? See how India’s fitness culture and whey protein market are transforming health and business.

References: Industry reports and news articles on the indian aviation market provide the data above. These include DGCA traffic statistics, OAG aviation analyses, and press releases detailing brand campaigns. Each citation corresponds to the latest available figures and marketing announcements.

According to India Brand Equity Foundation (IBEF), India’s aviation sector is among the fastest-growing in the world.

The Directorate General of Civil Aviation (DGCA) regularly publishes passenger traffic, market share, and fleet data.

IATA’s 2024 Outlook also highlights India as a key growth driver in global air travel demand.