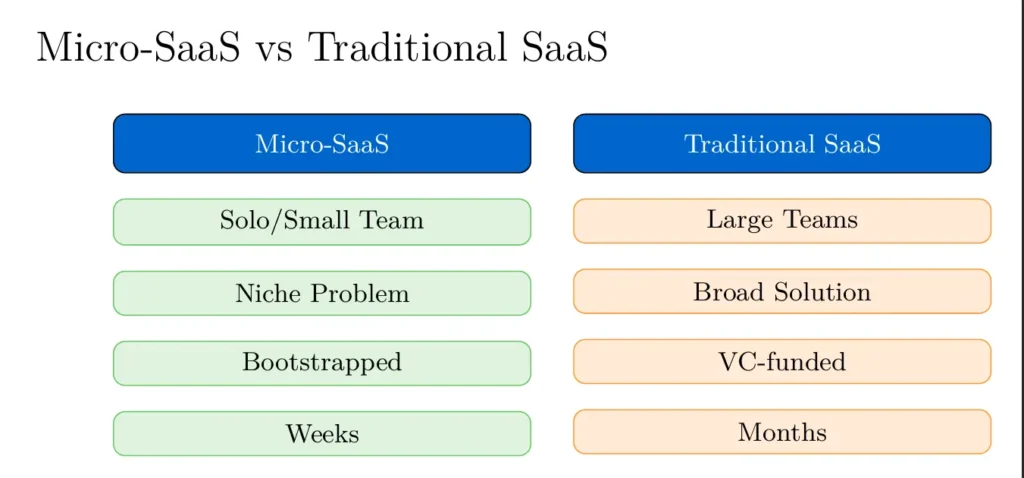

India’s SaaS scene is changing slowly but surely as more and more micro-SaaS startups pop up. These are small, specialized software companies run by one person or a small team on a tight budget. These companies, on the other hand, focus on solving specific problems, like Slack bots for polls or invoicing tools that use UPI. India’s digital economy is a great place for this kind of innovation because it has more than 950 million internet users. As of 2021, 1,000+ Indian SaaS companies generated $2.6B in revenue, a number McKinsey predicts could reach $70B by 2030 (mckinsey.com). Micro-SaaS founders are tapping this growth, often bootstrapped and VC-free (saasboomi.org).

India’s booming digital ecosystem helped too. Government-led programs like Digital India and UPI have built a vast infrastructure for online business. Today, there are 650 million smartphone users and 950 million internet subscribers (trade.gov), and 80% of retail payments run on the Unified Payments Interface (trade.gov) (trade.gov). In this climate, even micro-budget apps can find customers instantly. Early micro-SaaS makers in India often cite online communities (like Twitter’s “build in public” crowd) for inspiration. As one founder, Shri Vatz, recalls, discovering the “build in public” community on Twitter was a turning point in launching his tool (microns.io).

Bootstrapped ethos is in India’s DNA: many of the earliest SaaS successes here – Greytip, Zoho – started without outside money. Micro-SaaS is an extension of that tradition. As Sramana Mitra notes, “Greytip has pioneered the SaaS model in India. They successfully bootstrapped a SaaS company while keeping their primary focus on Indian corporations” (sramanamitra.com). Today, dozens of new founders in smaller cities and tier-2 towns (beyond Bangalore/Chennai) are following suit, creating “Indian SaaS companies” one niche at a time.

Brand Positioning and Strategy: Lean & Customer-Centric

Micro-SaaS startups position themselves very differently from the large SaaS giants. Instead of broad feature sets for all, they boil down to one core solution. This lean approach has big strategic advantages. By focusing on a narrow problem, micro-SaaS makers build deep relationships with their users (saasboomi.org). For example, a micro-SaaS developer selling a Google Sheets-based website builder listens directly to each of their 10–20 customers, adjusts the roadmap on the fly, and offers highly personalized support. This “customer-first” strategy is easier when the team is just one or two people, no layers of management – so changes happen in real time.

Another angle is trust. When customers know they’re dealing with a founder or small team who genuinely cares, loyalty skyrockets. A coach buying a lifetime seat in a webinar scheduling app by an indie maker will likely feel more personal support than signing up for Salesforce. That intimacy also translates into branding: micro-SaaS can be witty, grassroots, even family-sounding brands – think simple names or mascots – whereas big SaaS logos are often corporate.

In short, Indian micro-SaaS startups often brand themselves as the little engine that could: nimble, affordable and utterly devoted to user needs. They flaunt “no VC fluff, just practical software” in their messaging. This resonates especially with other scrappy startups and freelancers (their peers) who appreciate the understatement.

Many Indian brands are adopting innovative positioning strategies, just like Mahindra’s marketing strategy that balances legacy with modern growth, or boAt’s disruptive play in Indian audio leveraging influencer-driven campaigns.

Differentiation: Niche, Affordable and No-Code

Key differentiators set micro-SaaS apart from traditional players. Some standouts:

- Niche Focus: These products solve very specific problems. Examples include a testimonial-collection widget, a Zoom follow-up scheduler, or an invoicing tool for micro-retailers. Rather than competing feature-for-feature with major platforms, micro-SaaS finds a corner to own. By addressing a unique pain point, they build a loyal micro-market. As SaaSBoomi explains, targeting a well-defined segment allows “micro SaaS businesses to address unique needs and build strong relationships with their customers” (saasboomi.org). In practice, a founder might say: “I’m not making Uber; I’m making an Uber-tracking plugin for local delivery drivers.”

- Low Overhead & Pricing: Without big teams or offices, micro-SaaS can charge just enough to cover costs and profit. This often makes them much cheaper for customers. Many run on a low-cost “freemium” or single-fee model. For example, one micro-SaaS might charge $5/month per user, undercutting the $50/month charged by enterprise tools. Their profit margins are huge since most expenses are just hosting or APIs. [SaaSBoomi notes minimal operating costs make these ventures sustainable (saasboomi.org.)] In India, especially, offering tools at 1/10th the price of Western alternatives can capture local customers who are price-sensitive.

- No-Code & AI Tooling: Founders leverage modern platforms to build fast. Many Indian micro-SaaS makers use no-code/low-code tools (Bubble, Webflow, Airtable) and serverless backends (AWS Lambda, Firebase) to slash development time (linkedin.com). This democratizes tech: even non-programmers can launch products. On top of that, AI and automation play a big role. Simple AI integrations (GPT APIs, Zapier workflows, chatbot libraries) let a two-person team deliver features that used to need more engineers (linkedin.com). For instance, an AI could auto-generate personalized email subject lines, or a script could scrape LinkedIn leads – tasks that would be manual with older tech. In short, modern tools let Indian micro-SaaS founders spin up sophisticated apps with minimal code.

- Alignment with India’s Digital Wave: Micro-SaaS fits India’s tech trends. The country’s smartphone and internet boom (trade.gov) means even small businesses and freelancers are online. Micro-SaaS companies integrate with India-specific rails. Many include UPI payments right out of the box, since UPI drives ~80% of Indian retail transactions (trade.gov). They might offer Hindi/other-language support or work well on low bandwidth. Integration with global tools also matters: Slack’s platform hosts 2,600+ apps for workflow automation (slack.com), so a micro-SaaS can launch as a Slack plugin. Or a product might plug into Google Workspace, WhatsApp Business, or Payment APIs. These integrations make the apps feel native. In essence, micro-SaaS start-ups align their stack with India’s digital economy – using UPI, NEFT, or other local protocols – while also tapping global channels like Stripe or Slack where needed.

Just as Noise’s business model focuses on affordability in smart tech, Micro-SaaS tools offer startups budget-friendly, high-utility solutions tailored for niche markets.

Notable Case Studies Related To Indian Saas Companies

These lean strategies are already bearing fruit in India. Here are some real growth stories:

- ColdDM (Twitter Outreach Tool) – Founder Shri Vatz from India built a simple Twitter cold-messaging app (ColdDM) in about a month. The solo dev had ~4 customers and roughly $80 ARR when he listed it on Microns.io (a micro-startup marketplace) (microns.io). Remarkably, it sold in 4 days for $6,000 (microns.io). The buyer then grew it to ~$2K MRR, a ~4× return on investment, selling again later at an even higher price (newsletter.microns.io). Shri credits the Twitter “build in public” community for the idea and early adopters (microns.io). His story shows how even tiny products (and revenue) can lead to profitable exits and networking wins.

- Kaapi (Remote Team Feedback Tool) – Though headquartered in Argentina, Kaapi is led by Indian founder Aditya Rao and built by a 3-person team. They focus on one thing: improving feedback and surveys for remote companies. Without any outside funding, Kaapi hit about $12K ARR and counted 500+ users by 2023 (getlatka.com). They plan to continue adding AI features. Kaapi exemplifies micro-SaaS global reach: it’s selling into world markets with minimal staff, leveraging just the team’s talent and open-source tech.

- WeBuilda (AI Website Builder) – Kenyan founder Enoq Moka created WeBuilda, an AI-powered, no-code website builder, in about 2 months and generated ~$4K ARR (microns.io). He built it solo for ~$680 using React, Firebase and ChatGPT. In 2024 he sold it for $7,200 on Microns. (We mention this because it highlights how generative AI is enabling new micro-SaaS products – a trend that Indian developers are also embracing.)

Beyond specific products, market data reflects this trend. A recent report notes an uptick in vertical SaaS and micro-SaaS: “specialized, niche tools that enable new market entrants to address specific customer needs quickly” (communicationstoday.co.in). NASSCOM and analysts project India’s SaaS sector reaching ~$50B by 2030 (communicationstoday.co.in), much of it driven by thousands of startups (large and small). Indian micro-SaaS founders, though tiny, are helping push that total up.

Challenges and Criticisms

Micro-SaaS isn’t a silver bullet. Startups should be honest about limitations:

- Scalability: By definition, micro-SaaS targets a narrow niche. That means the total market size can be small (saasboomi.org). A product solving a hyper-local problem (say, scheduling maintenance for a specific machinery brand) might not scale beyond a few hundred users. This cap on growth opportunities is a known risk. Founders need to either broaden features over time or launch new niche products to keep revenue climbing.

- Competition: Micro-SaaS’s low barriers also invite competition. Another solo dev could clone your idea quickly. SaaSBoomi warns that “focusing on a niche market can limit growth” and that easy entry “can lead to increased competition” (saasboomi.org). In India’s case, global giants are also eyeing every segment. A micro-invoicing app might eventually face payment unicorns or a local startup supported by big investors. Staying ahead means obsessively listening to users and innovating constantly.

- Funding & Resources: Most micro-SaaS are bootstrapped or self-funded. That’s often an advantage (no VC pressure), but it also means limited marketing budgets. Many will never afford a large sales team or expensive ads. They rely on SEO, word-of-mouth, or platforms like Product Hunt for visibility. This can slow growth. Additionally, founders may need to wear many hats (dev, sales, support), which can strain small teams.

Despite these challenges, many micro-SaaS makers see them as features, not bugs. They lean into agility to iterate fast. If one niche dries up, they pivot. If the product cap is reached, they sell it and move on (as in the ColdDM example). The key is being realistic: micro-SaaS is not about instant unicorns, but about sustainable, profitable niche play.

Product Portfolio and Technology

What kinds of tools do Indian micro-SaaS startups build? Here are some common offerings and tech trends:

- Micro-Tools for Startups/Freelancers: Simple CRM plugins, lead-gen widgets, social media schedulers, Kanban boards for solopreneurs, or time-tracking apps. For example, an India-based micro-SaaS might offer a “one-click WhatsApp survey link generator” for local retailers or a UPI invoice generator for freelance graphic designers.

- Industry-Specific Apps: Niche industries open up opportunities. Some Indian micro-SaaS target teachers (class management tools with UPI fees), fitness instructors (booking and payment), or regional retail (inventory apps for mom-and-pop stores). These vertical tools often require only domain knowledge plus a tech stack.

- Built-on Modern Platforms: Many are built with no-code/low-code platforms, using APIs from Stripe/UPI, Firebase, or AWS. Chatbots, AI form-fillers, or GenAI content helpers (summarizers, image generators, etc.) are popular. (For instance, a micro-SaaS might let anyone design marketing posters with simple prompts, leveraging an AI image API under the hood.)

- Integrations (Slack, UPI, etc.): Integration is key. Slack’s ecosystem alone offers 2,600+ ready-to-use apps (slack.com), and many micro-SaaS launch as a Slack app or Slackbot. Similarly, tools integrate with Gmail, Google Sheets, Microsoft Teams, Zapier, etc. Crucially for India, payment flows often plug straight into UPI or local banks. This makes adoption seamless for domestic SMBs. For example, a time-tracking app might send invoices via UPI automatically every month.

- AI and Analytics: AI features are now almost a given. Our example WeBuilda used ChatGPT for content and site templates. Other micro-SaaS might use AI to analyze a customer’s data and make recommendations. Basic analytics dashboards (sales over time, churn charts) often come built-in, powered by services like Google Analytics or Metabase.

Overall, the tech stack of micro-SaaS is typically modern and lightweight. They avoid monolithic codebases; many are JAMstack (JavaScript + APIs) apps or fully serverless. This means updates can be rolled out with a Git push or a config change. The result: Indian SaaS startups (of any size) are increasingly AI-first and cloud-native, following global trends (communicationstoday.co.in) (trade.gov).

India’s booming sectors, such as electronics sales strategies in retail & e-commerce, create a fertile ground for Micro-SaaS products that cater to operational and marketing efficiencies.

Takeaways for Marketers

What can marketing students and professionals learn from India’s micro-SaaS boom? Here are actionable lessons:

- Embrace a Narrow Focus and Lean Launch: Success often starts with a single use-case. Identify a painful problem for a small group of users and solve just that. Build an MVP fast (consider no-code tools to prototype in days). This lean approach keeps costs low and feedback loops tight. As one micro-founder noted, small products can “outperform bloated platforms” by staying lean (linkedin.com).

- Optimize for SEO and Content: Without big ad budgets, micro-SaaS live or die on inbound marketing. Create helpful content (blogs, tutorials, niche-specific guides) to rank for keywords your customers search. For example, a scheduling app could publish “How to use UPI for online bookings” or “Best tools for yoga instructors in India”. Target the long-tail keywords your micro-market cares about (e.g. “b2b SaaS companies in India payroll software”). This builds organic traffic over time.

- Build Community and “Ship in Public”: Engage with maker communities. Document your journey on Twitter or LinkedIn (the “build in public” model). Participate in forums like Indie Hackers or SaaSBoomi, and ask for feedback. Community interest can become early traction. Founder Shri’s story shows the power of this: he learned from other makers online and eventually listed his product on Microns to sell (microns.io) (newsletter.microns.io). Hosting webinars, being active in relevant Slack groups, or even running a small newsletter can turn users into evangelists.

- Leverage Partnerships and Integrations: Don’t build everything yourself. Integrate your SaaS with popular platforms (Slack, Shopify, WordPress, etc.) and partner with complementary tools. For example, if you’re selling a CRM plugin, integrate it with Gmail and WhatsApp so leads can sync. If you can co-market on the platform (Slack’s App Directory, Shopify App Store), you tap into a built-in audience. Automation partnerships (Zapier, IFTTT) can also expand your use cases without extra development.

- Focus on Brand Authenticity: Micro-brands win by being human. Use a friendly tone, share your origin story, and offer real support. Case in point: many founders openly share pricing transparency, roadmaps, or even failures in blog posts. This honesty builds trust. Remember, many customers for micro-SaaS are friends-of-friends or small biz owners who value personal touch. A witty, cheerful brand voice (with some self-deprecating humor or local flavor) can stand out more than a generic tech-speak stance.

- Scale Prudently with Automation: Once you gain traction, automate everything you can: support emails (canned responses), billing (Stripe/UPI auto-invoicing), and marketing (email drip sequences). Use data: track which feature usage correlates with retention, and double down on it. Carefully reinvest profits into growing user acquisition (e.g. small targeted ads or SEO tool subscriptions) rather than large overheads. In micro-SaaS, a little goes a long way – scaling often means launching the next niche product rather than bloating the original.

For more brand and market strategy breakdowns, explore how FabIndia builds consumer trust or the Samsung success story in India.

Watch how solo founders are leveraging no‑code AI to launch micro‑SaaS and hit $10K/month—proof of what’s possible with lean teams and modern tech

Each lesson reflects the bootstrapped startup in India mentality: smart frugality, community focus, and constant learning. The rise of micro-SaaS shows that even without millions in funding, a small Indian team can build something customers love and scale it globally.

If you’re interested in broader market trends, check out our analysis on the Indian aviation market trends or how Blinkit is redefining quick commerce in India.

Which Micro-SaaS startup inspires you? Share your favorites in the comments! For more stories and growth insights, subscribe to our newsletter.

Sources

- SaaSBoomi – Micro SaaS Definition & Insights – Definition, advantages and challenges of micro-SaaS (niche focus, low overhead).

- McKinsey – India’s Tech Future (SaaS Growth Forecast) – Notes over 1,000 Indian SaaS startups generating $2.6B (2021) and projected to reach ~$70B by 2030.

- U.S. Commerce – India Digital Economy Guide – Details India’s digital transformation (650M smartphones, 950M internet users) and rise of UPI & digital payments.

- Communications Today – “SaaS — Alive, Evolving, and Indispensable” – Discusses vertical/micro-SaaS trends and projects Indian SaaS to ~$50B by 2030.

- SaaSBoomi – “Charting India’s $1 Trillion SaaS Aspiration” – Reports India’s SaaS community growth (300→4,000 companies) and examples of bootstrapped giants like Zoho.

- Sramana Mitra – Bootstrapping SaaS in India (Greytip) – Interview noting Greytip’s bootstrapped success and focus on Indian clients.

- Microns – Case Study: Shri’s ColdDM Micro-SaaS – Showcases an Indian founder (Shri Vatz) who bootstrapped a Twitter outreach tool (ColdDM) to $80 ARR and sold it for $6K in 4 days.

- Latka – Kaapi Team Profile – Public SaaS database entry: Kaapi (Indian founder) has 3 employees and ~$12K revenue (ARR) with no funding.

- Slack – Slack Platform Overview – Highlights that “Over 2,600 apps are ready to connect in Slack” for task automation, illustrating integration opportunities.