Noise (aka Noise Now) is an Indian audio and wearables brand founded in 2014 by cousins Amit and Gaurav Khatri. Originally making mobile accessories, it quickly pivoted to smartwatches, earbuds, and other Noise audio products under a “Made in India, Made for India” ethos. Like FabIndia’s emotional branding, its local-first approach builds strong loyalty. Today, Noise ranks among India’s top wearable brands and global smartwatch leaders. With 95% of products made locally and years of bootstrapped growth, the Noise business model focuses on affordability, sustainability, and India-centric innovation.

Noise business model product line covers a full ecosystem of connected devices. Its audio products include true wireless stereo (TWS) earbuds and neckbands, Bluetooth headphones, and portable speakers. Meanwhile, its wearable range encompasses smartwatches, fitness bands, and even a smart ring. (For example, the flagship Master Buds TWS earphones feature “Sound by Bose” tuning (entrepreneur.com) (outlookbusiness.com). In recent years, smartwatches have driven the bulk of Noise’s revenue (around 80%), with earphones and other audio devices making up the rest (storyboard18.com). Notably, Noise continues to invest in R&D and innovation – from introducing industry-first features (like gesture-controlled earbuds) to launching premium models – as part of its strategy to stay ahead of competitors (storyboard18.com) (outlookbusiness.com).

Inside The Noise Business Model: Growth Story & Expansion

Noise’s journey has been fueled by steady organic growth and occasional strategic funding. For almost a decade, the company remained completely bootstrapped and profitable, with founders reinvesting revenue into the business (storyboard18.com). Its first external funding came only in late 2023, when Bose invested $10M in a Series A round (later augmented by a $20M raise) (entrepreneur.com) (storyboard18.com). These investments are being used to ramp up audio innovation (leveraging Bose’s expertise) and accelerate expansion.

Like many D2C brands, the Noise business model combines online and offline sales – with 80% from its website and platforms like Amazon, and 20% from 20,000+ retail outlets across India. To boost visibility and trust, Noise is expanding its offline presence through electronics chains. Its strong “Make in India” focus keeps production local (via partners like Il Jin Electronics), helping reduce costs and meet regulatory norms. Much like Mahindra’s diversified marketing model, Noise combines multiple distribution and brand-building levers to create a powerful customer experience.

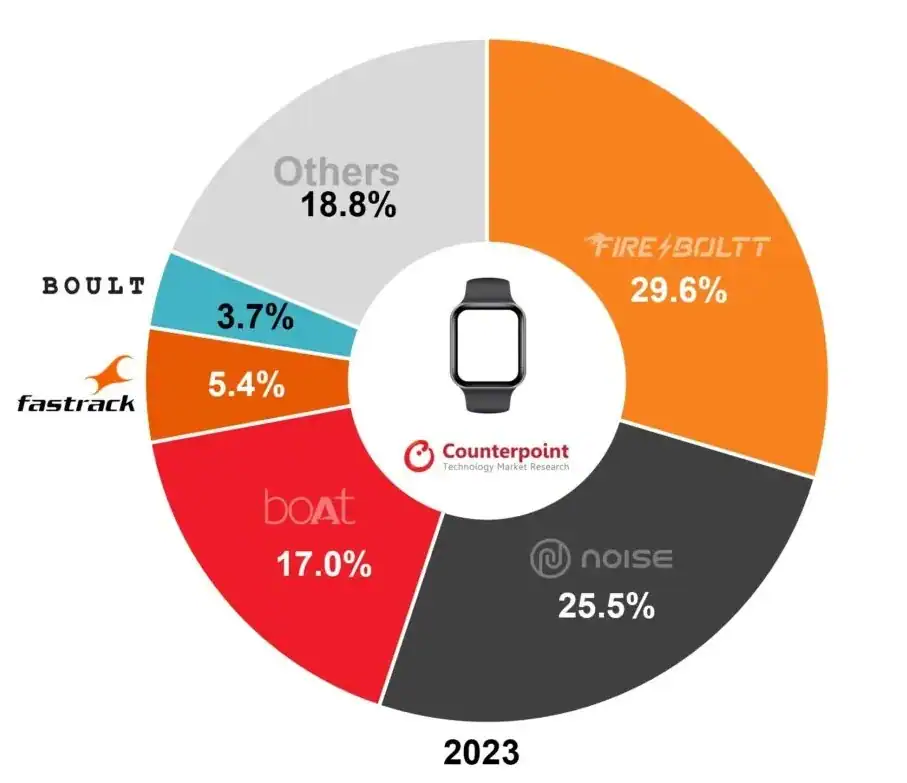

Key statistics: Today Noise reports revenues in the low ₹1,400–1,500 crore range, and has consistently led the Indian smartwatch segment (e.g. ~25–27% market share in recent quarters (outlookbusiness.com) (gizmochina.com). This market leadership validates the founders’ vision of creating a “tech lifestyle” brand for India – one that understands local consumer needs while offering global-standard products (timesofindia.indiatimes.com) (storyboard18.com).

Products And Technology

Noise’s portfolio is broad:

- Smartwatches & Bands: Models like the ColorFit and NoiseFit series, offering fitness tracking, color screens, and smartphone connectivity. These come in various price tiers, from budget to premium.

- Wireless Earphones/Headphones: From basic Bluetooth neckbands to advanced TWS earbuds (like the Noise Master Buds with active noise cancellation and Bose sound tuning) (entrepreneur.com) (outlookbusiness.com). Noise has been rapidly growing in the wireless audio space, targeting a share of India’s booming earbuds market (storyboard18.com) (outlookbusiness.com).

- Speakers & Accessories: Portable Bluetooth speakers, wired headphones, and other audio gadgets under the Noise brand.

- Smart Ring: Recently, Noise entered the nascent smart-ring category (the Luna Ring) (timesofindia.indiatimes.com), tapping the emerging trend of wearable tech beyond wrists.

Each product line reflects Noise’s focus on innovation at accessible price points. The brand often updates designs (new sensors, health features, improved audio codecs, etc.) in response to customer feedback (timesofindia.indiatimes.com) (storyboard18.com). For example, Noise was the first Indian brand with gesture-controlled TWS earbuds (gizmochina.com). Its collaboration with Bose has particularly boosted its mid-to-premium audio offerings (the Sound-by-Bose earbuds and tech partnership) (outlookbusiness.com) (entrepreneur.com).

Market Position And Competition

In India’s crowded consumer-tech market, Noise has carved a significant niche. According to IDC research, Noise leads the smartwatch category with roughly 25–27% market share (well ahead of rivals like boAt at ~17% in late 2024) (gizmochina.com). It was also the #1 smartwatch brand for multiple quarters in 2023–24 (outlookbusiness.com) (storyboard18.com). In the overall wearables space it usually ranks in the top two. In one recent quarter it held the second position with about 10–11% of the entire wearable market (which includes bands and audio as well) (timesofindia.indiatimes.com). This hybrid distribution strategy aligns with broader electronics sales strategies in India, where combining e-commerce with offline stores builds trust and visibility.

Major competitors include other Indian startups and tech firms: boAt (Imagine Marketing), Fire-Boltt, Boult Audio, and global players like Samsung, Xiaomi and Noise’s parent Zebronics (though Noise is under Nexxbase/Pinterest Brand?). boAt in particular is a close rival in audio devices; Noise’s products and marketing often vie for the same young, tech-savvy customers as boAt (timesofindia.indiatimes.com) (brandequity.economictimes.indiatimes.com). For a deeper look at how boAt approaches the youth market, explore our boAt marketing strategy breakdown.

Despite heavy competition, Noise stays ahead with its India-first strategy and wide distribution network. Its “Make in India” edge allows competitive pricing, while local partnerships boost reach in Tier 2–3 cities. Celebrity campaigns, like Virat Kohli’s endorsement, and strong influencer marketing enhance its youth appeal. Overall, the Noise business model thrives by combining local design, domestic manufacturing, and smart pricing to outpace global imports in smaller markets.

Marketing And Brand Building

Noise blends tech-focused marketing with lifestyle appeal. It promotes advanced features like battery life and health sensors while projecting a youthful, aspirational image. Celebrity endorsements, like Virat Kohli and others, boost its visibility. Campaigns like “Made of Noise” emphasize youth empowerment. The brand leans on digital ads, influencers, and social media to connect with tech-savvy consumers (Storyboard18). This strategy aligns with tactics seen in Samsung’s success and echoes the youth-wellness trends explored in our fitness culture overview.

This approach fits well with the rise of youth wellness trends in India, where wearables and fitness tracking are merging with lifestyle.Future Outlook

Looking ahead, Noise is aiming to replicate its India success globally. International expansion and higher-end product launches are the next frontier in the evolving Noise business model, which aims to scale while staying rooted in Indian consumer behavior.

This mirrors the international expansion playbook seen in the Samsung success story, where strong domestic roots helped fuel global scale.The global moves complement a domestic focus on higher-end products: Noise plans more mid-premium gadgets (₹2,000–10,000+) and continued innovation in areas like AI integration (outlookbusiness.com) (storyboard18.com). With Bose’s backing and strong Indian market share, Noise is well-positioned to grow. Industry analysts note that while India’s wearable market has temporarily slowed, brands like Noise that balance affordability with innovation – especially in the “made in India” category – are likely to expand share when the cycle turns (outlookbusiness.com) (storyboard18.com).

In summary, Noise’s story is one of steady bootstrapped growth. By building a broad portfolio of noise audio products and smart wearables, leveraging local manufacturing, and aggressively pursuing distribution, the company has become a national leader and an emerging global player. As competition heats up, Noise’s deep understanding of Indian consumers and its mix of offline reach (20,000+ stores) and online marketing will be critical in sustaining its momentum (storyboard18.com) (timesofindia.indiatimes.com).

All Sources

- Noise announces UK/EU expansion – Outlook Business

- Amit Khatri on Noise’s 10-year journey – Times of India

- Noise Raises USD20M from Bose – Entrepreneur India

- Noise as Bose invests – Times of India

- Noise’s profitable bootstrapped strategy – Storyboard18

- Noise leads smartwatches – Gizmochina (IDC)

- Noise onboard Virat Kohli – ET Brand Equity