Introduction

Tanishq marketing playbook begins with the story of Titan Company’s flagship brand, a part of the Tata Group. It is a symbol of trust, skill, and emotional connection in India’s jewellery market. Tanishq has revolutionized the way Indians purchase gold and diamond jewellery since its inception. Instead of relying on local jewellers and trusting them, customers now have a modern shopping experience. Tanishq has more than 300 stores and an estimated 8% market share in 2024. It mixes traditional and modern styles to appeal to a wide range of customers through bold campaigns and new ideas. This blog post talks about its journey, branding, its competitive edge, and what marketers and business owners can learn from it.

Just as brands like Mahindra and Royal Enfield have built a legacy of trust and tradition, Tanishq carries the same weight in India’s organized jewellery market.

Origin Story

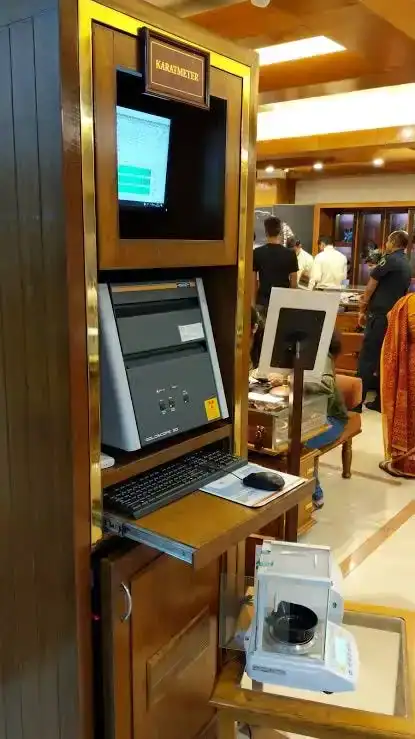

Tanishq was launched by Titan in 1994 to export 18-karat gold jewellery and boost India’s foreign exchange reserves. The name, coined by MD Xerxes Desai, blends “Tan” (body) and “Nishk” (gold ornament), which reflect a focus on wearable art. But global setbacks led to a pivot, and in 1996, Tanishq opened its first store in Chennai, marking India’s first organized jewellery retail chain. Early losses stemmed from the 18-karat offering, which didn’t resonate with Indian buyers. A switch to 22-karat gold and the introduction of the karatmeter helped build trust. By 2003, Tanishq ranked among India’s top five retailers and contributed 40% of Titan’s revenue.

Brand Strategy: The Tanishq Marketing Playbook

Tanishq’s brand flourishes on emotive storytelling rooted in relationships, tradition, and modern aspirations. Its ads often feature strong women and life’s meaningful moments. Sub-brands like Rivaah, Mia, and Zoya cater to varied audiences, while the Tata name reinforces trust and quality. Campaigns like “When It Rings True” blend cultural nuance with authenticity, giving the brand global appeal. A strong digital presence, influencer tie-ups, and over 60% of sales from e-commerce reflect its modern reach.

Like FabIndia’s culture-rooted branding, Tanishq also weaves emotion, identity, and tradition into its storytelling, making it more than just a jewellery brand.

Differentiation from Competitors

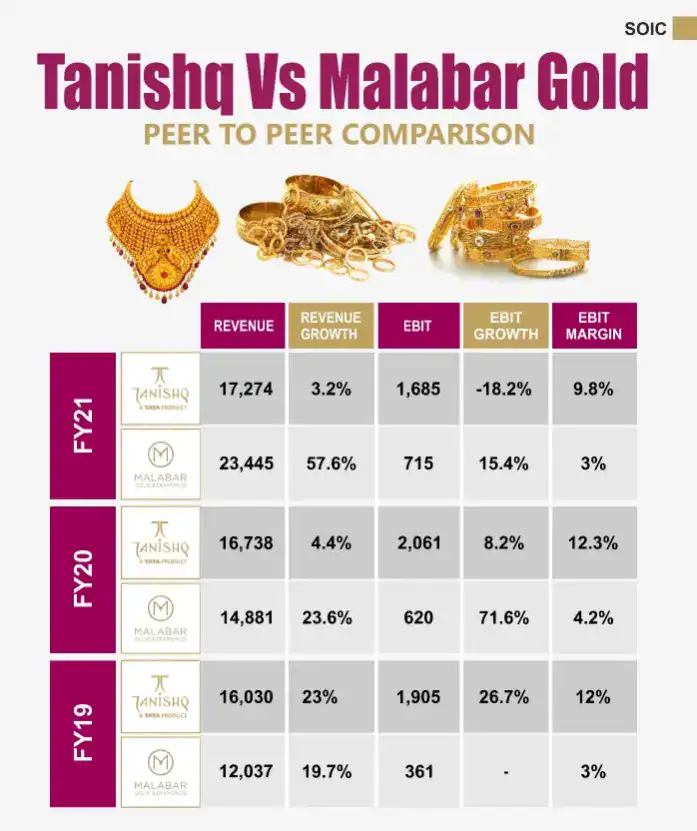

Tanishq stands out in a market full of unorganized local jewellers and competitors like Malabar Gold, Kalyan Jewellers, and PC Jeweller because of a few important factors:

- Purity Assurance: The karatmeter made it possible for customers to check the purity of gold in stores, which was a big problem in a market where trust was often low. Tanishq’s “Impure to Pure” program, which permits customers to trade in lower-purity jewellery for free (only paying for the work), built trust and loyalty.

- Modern Retail Experience: Tanishq has over 300 stores in India and offers a luxurious, customer-focused shopping experience that is different from the cramped, less transparent stores of local jewellers.

- Tata Brand Trust: Because the Tata Group is known for being honest and making high-quality products, Tanishq is more credible than local competitors.

- Diverse Portfolio: Tanishq stands out from competitors like Kalyan Jewellers, which only recently raised its diamond share to 30% (up from 22% in 2022), because it focuses on diamond-studded jewellery, which has higher margins.

- Innovation: Tanishq uses technology like virtual try-ons and an omnichannel approach that brings together online and offline experiences to appeal to modern customers.

Tanishq’s use of AR-powered try-ons mirrors the kind of innovation seen in brands like Noise and boAt, both of which have redefined tech-driven personalization in Indian retail.

Some competitors, like Malabar Gold, offer international designs, and Kalyan Jewellers has prices that are hard to beat. Tanishq, on the other hand, has a unique position because of its mix of trust, quality, and emotional branding. But its high prices can be a problem for customers who are sensitive to price, which is where local jewellers or brands like PC Jeweller may have an advantage.

| Competitor Comparison | Tanishq | Malabar Gold | Kalyan Jewellers | PC Jeweller |

|---|---|---|---|---|

| Market Share (2024) | ~8% | ~3-4% | ~3.7% | ~2-3% |

| Key Strength | Trust, purity assurance | Global designs | Competitive pricing | Intricate designs |

| Store Count | 475+ | 300+ | 217+ | 80+ |

| Focus | Emotional branding, diamonds | International appeal | Regional expansion | Affordable luxury |

Note: Market share estimates vary by source; figures are approximate based on available data.

Key Campaigns

People often talk about Tanishq’s ads because they are so emotional and relevant to society. Listed below are three notable examples:

- Ekatvam (2020): This campaign, meaning “oneness,” promoted unity through a story of a Muslim family hosting a Hindu baby shower for their daughter-in-law. Although praised for its message of interfaith harmony, it faced backlash for allegedly promoting “love jihad,” which led to the #BoycottTanishq trend. Tanishq pulled the ad because it was worried about the safety of its employees, but the controversy made it more well-known, and many people supported its progressive stance, The Hindu.

- Marriage Conversations (2021-2022): Launched with Dentsu Webchutney, this campaign encouraged couples to discuss life after marriage, covering topics like financial stability and mental health. It hit home with young, modern couples, building upon Tanishq’s relevance in modern relationships, Business Insider India.

- Little Big Moments (2023): This campaign represented a move toward stressing ordinary accomplishments and self-love. Tanishq revamped jewellery as a statement of freedom and joy—not merely a gift from others by depicting women presenting themselves with jewellery to mark personal achievements,

These campaigns indicate Tanishq’s ability to mix emotional storytelling with social commentary, though not without risks, as seen in the Ekatvam controversy

Handling Controversies

Tanishq’s bold social messaging has sparked both praise and controversy. The Ekatvam campaign aimed to promote unity but faced backlash for its interfaith theme. Although some saw the brand’s withdrawal as a sign of weakness, industry bodies like the International Advertising Association supported its intent (LiveMint). Despite the criticism, the campaign boosted visibility and reinforced Tanishq’s progressive image. Like its second marriage ad, Tanishq’s willingness to address sensitive topics shows a careful balance between boldness and public sentiment — a key lesson in protecting brand reputation in a polarized market.

Like how Haldiram navigates legacy and modern consumer expectations, Tanishq too finds itself at the crossroads of tradition and progressive values, often sparking both admiration and debate.

Product Portfolio and In-Store Experience

Tanishq’s product portfolio is diverse that cater to various customer needs:

- Rivaah: Bridal jewellery tailored to regional wedding traditions.

- Mia by Tanishq: Trendy, lightweight pieces for daily wear, targeting working women.

- Zoya: Luxury collections for premium customers.

- GoldPlus: A now-merged brand for middle-class and small-town markets.

- Others: Gold, diamond, platinum, and gemstone jewellery, including earrings, necklaces, and mangalsutras.

Tanishq has more than 475 locations and offers a high-end shopping experience with a focus on customized service and honesty. The karatmeter, accessible in stores, lets customers test gold purity, boost confidence. Tanishq’s omnichannel approach blends online and physical purchasing, with over 60% of revenues from e-commerce. The brand has embraced technology, especially through augmented reality (AR) virtual try-on features. As an example, Tanishq worked with Vossle to offer a virtual try-on for its Polki line in the metaverse. This lets buyers see how the jewellery looks on their phones. TechStory says that mirror AR experience zones at airports can provide an interactive purchasing experience.

Modern retail strategies like those discussed in our electronics sales breakdown also reflect in how Tanishq blends physical and digital experiences through omnichannel presence and innovation.

Strategic Summary

Tanishq’s success originates from a mixture of trust, creativity, and emotional connection. After bringing the karatmeter and open processes, it dealt with customer concerns about gold purity and set a new standard in a fragmented industry. Its emotive advertising, including “Marriage Conversations,” connects with current ideals, whilst sub-brands like Mia and Rivaah appeal to varied sectors. Tanishq’s utilization of innovations like virtual try-ons and an omnichannel presence keeps it ahead of the competition. Despite periodic conflicts, its desire to engage with social concerns boosts its appeal among progressive customers. Given a 20% revenue increase to ₹38,353 crore in FY24, Tanishq’s tactics give a model for developing a trusted, creative brand, LiveMint.

Much like Blinkit is reshaping instant gratification in commerce, Tanishq is redefining convenience and credibility in jewellery buying through digital-first thinking and customer trust tools.

Takeaways

- Build Trust Through Transparency: Use tools like the Karatmeter to address consumer pain points and establish credibility.

- Leverage Emotional Storytelling: Create campaigns that resonate with cultural and emotional values to foster deep connections.

- Innovate in Retail and Technology: Adopt modern retail formats and technologies like AR to enhance customer experiences.

- Engage with Social Issues Thoughtfully: Take bold stances on social topics but be prepared to navigate backlash diplomatically.

- Adapt to Market Needs: Pivot strategies based on consumer feedback, as seen in Tanishq’s shift to 22-karat gold.

Sources

- MyWisdomLane – How Tanishq Became India’s No. 1 Jewellery Brand – Strategic pivots, sub-brands like Gold Plus, Zoya, and Mia, and company insights.

- Wikipedia – Tanishq – Brand history, expansion timeline, and product portfolio.

- Tanishq Official Website – Inside Tanishq – Brand ethos, design philosophy, and craftsmanship.

- Titan Company – Tanishq – Company’s overview of Tanishq’s role in modernizing jewellery retail.

- Tring – Tanishq: Brand of Storytelling – Shift from celebrity endorsements to emotion-driven campaigns.

- Finfloww – Ratan Tata’s Pivotal Decision – Tanishq’s move from 18K to 22K gold and rise in the wedding segment.

- The Hindu – Ekatvam Controversy – Report on the backlash and withdrawal of the interfaith ad.

- Moneycontrol – Tanishq’s Bold Campaigns – Compilation of Tanishq’s viral ads and brand messaging.

- LiveMint – Industry Backs Tanishq – Support from advertising associations during ad backlash.

- Vossle – Virtual Try-On for Polki Collection – AR-powered online try-on experience developed for Tanishq.

- TechStory – mirrAR Experience Zones – Virtual shopping experiences launched at Indian airports.

- LiveMint – Titan FY24 Growth – Financial growth updates and Tanishq’s contribution to Titan’s revenue.

- X Post – GSI Partnership – Announcement of gemological training tie-up with GSI.

- X Post – Titan Q1 Business Update – Noting Tanishq’s 20% growth and U.S. expansion.

- SlideShare – Brand Tanishq – Positioning, brand values, and retail strategies.